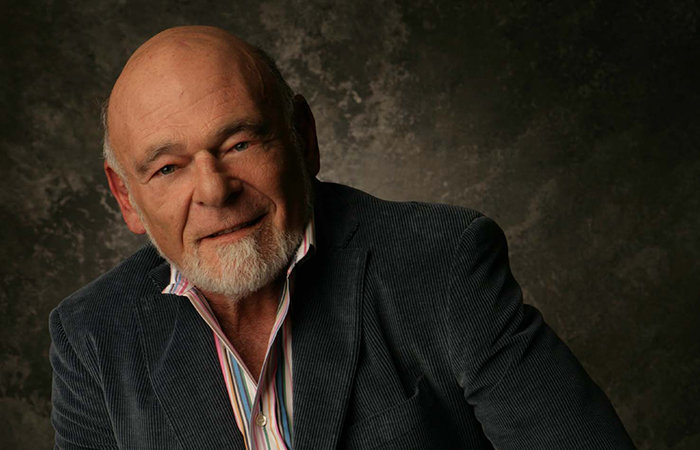

Sam Zell is a lifelong entrepreneur and philanthropist. Zell is the founder and chairman of Equity Group Investments.

“Taking risk is the only way to achieve extraordinary results — but you have to understand the downside,” said Sam Zell.

Widely known for his role in building the $1 trillion modern real estate investment trust (REIT) industry, Sam Zell is no stranger to those who know business. But there may be more to Zell than some realize: he’s an allocator of capital across industries from manufacturing and logistics to energy and healthcare. In fact, he describes himself as an entrepreneur, an investor, and a professional opportunist.

Get Paid for the Risk

As the saying goes, no risk, no reward. Zell strives to take “smart” risks, which means having a deep respect and awareness for how investments can go wrong. Often, he loosely quotes investor and presidential advisor Bernard Baruch: “Nobody ever went broke taking a profit.” That’s Zell’s way of punctuating the fact that investors tend to project how good an investment will be, and not nearly enough time on how bad it could get.

“I succeed by being very focused on as broad of an entry point as possible. I read voluminously. I listen. I try my best to be as educated as possible. You’ve got to start with being open enough to absorb everything, and then hopefully separate out the opportunities you think are viable.”

Zell will make big gambles if the reward justifies the risk. He seeks to identify and mitigate risks as much as possible, and what’s left over – the risks that can’t be mitigated – adds a premium to what he expects in return. A by-product of this approach is Zell often does deals no one else will touch, which offers a great advantage in an investment environment rich with capital chasing yield.

During his 50-year career, Zell has survived many economic downturns that have wiped out others. He calls that “staying power” and is known for his prescient nature, which ensures he has dry powder, or liquidity, to invest in distressed assets during downturns.

Culture is King

Even before “company culture” was a buzzword, Zell was doing it, and it’s something he credits much of his success to. At the heart of culture, he explained, is accessibility, transparency, and alignment. In practice, it starts with an open-door policy that facilitates sharing information and the ability to catch problems early. “No surprises” and “We don’t kill the messenger” are favorite mantras, as he wants to hear about problems early on so they can be fixed. The biggest risk, Zell believes, is in people “hiding the ball” – when they think they can minimize an issue or that it might resolve itself, and by the time it bubbles up nothing can be done to correct it.

“Long-term relationships reflect the most important lesson imparted to me by father. He taught me simply how to be. He often told me that nothing was more important than a person’s reputation — “shem tov” in the Jewish community: a good name. No matter how successful I got, I never forgot that lesson.”

That focus on transparency also applies to how his people work together. He warns against using “information as currency” to get ahead. It will backfire. In fact, he’s structured his team economically to ensure collaboration. Every one of the senior members at his investment firm personally invests, alongside him, in every investment they do. Everyone questions, probes, and challenges each other’s deal to find overlooked risks and opportunities. This type of culture cultivates a genuine interest and commitment for everyone’s investment to succeed.

Focus on the Long Haul

That basis is only part of the reason, however, that Zell’s employees never seem to leave. Many have worked for him for decades.

The center of his organization is Equity Group Investments, the private investment firm he founded more than 50 years ago. It manages all of Zell’s investments, including those in other multi-billion-dollar companies he’s founded, built, or stewards. This broad platform enables Zell to optimally deploy talent. Many of his executives have served within his various companies as advisors and in executive positions, including as CEOs. That eliminates the usual incentive – opportunity – for great talent to leave. Always doing something new and creating fresh avenues, Zell hopes his people will never stop “testing their limits.”

“For me, the calculation in making a deal starts with the downside. If I can identify that, then I understand the risk I’m taking. What’s the outcome if everything goes wrong? What actions would we take? Can I bear the cost? Can I survive it?”

Longevity doesn’t only apply to the legend’s approach internally, either. While other investors may have a reputation for ruthless negotiations, Zell doesn’t see deal making as a zero-sum game. He believes in leaving something on the table for his partners to achieve a win/win outcome. This thinking isn’t necessarily altruistic but practical – he wants everyone to come back for the next deal, and the next, and the next.

Zell eschews conventional wisdom and is consistently evolving to meet new marketplace dynamics. At 78, he is still in the office at 6:30 a.m. and leaves at 6:30 p.m.—that is, when he is not traveling to New York, Abu Dhabi, or another far-flung destination. Some wonder if he’ll ever retire. “Retire from what?” he quips. “I love what I do.” And that is perhaps the best practice of all.